So here’s the fun thing about the fourth quarter: You’ve only got so much time to get

stuff done before the holidays kick in, making everything merry…and complicated. One of those things you really need to make sure gets done is planning for your Affordable Care Act (ACA) reporting. I’ve been getting lots of spammy emails with a doomsday tone talking about getting this done now! Emergency! Freak out time! I wish this was just alarmist nonsense that could be ignored until I have time to think about it. But it’s not.

So here’s what you have to know…and do:

1. Who is required to report?

Everybody. Businesses of all sizes must withhold and report an additional 0.9 percent on employee wages or compensation that exceed $200,000. They may be required to report the value of the health insurance coverage provided for each employee. Large companies, those with more than 50 employees, who provide self-insured health coverage, have to file an annual return in 2016 reporting certain information for each employee covered. On the bright side, there are certain tax credits for doing all this. For details check out: http://www.irs.gov/Affordable-Care-Act/Employers

2. How long will it take to complete?

It depends on your payroll/HRIS system. If you are using an up-to-date software, your vendor has already created the solution for you which will be as easy as running reports in the system and pushing a few buttons. Yay for technology!

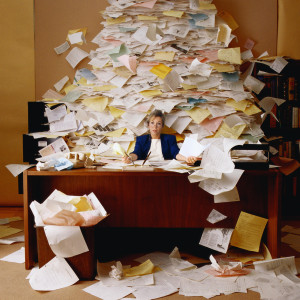

If not, and if you are thinking you can do this manually, you’re right. But it is going to take some time. You have to complete a corporate report and a report for each employee. I’m hearing from 15 minutes to two hours for each one. So how many employees do you have, anyway? If you average about an hour per employee…what’s that going to cost and how long will it take?

If calculating the answer to that question has you casting about for help, there are a few options. There are some stand-alone software solutions that will calculate and complete the forms, for a fee of course. All are new products/services, keep that mind.

If you’ve been thinking about switching payroll service companies and the ACA deadline has inspired you to act now…you may want to rethink that. Many payroll/HRIS companies have announced cut-off dates for accepting new clients. There are still some companies taking new clients, so all it not lost, but the timing has reduced your choices. You probably don’t want to make a decision as potentially big as a new payroll vendor on ACA reporting only.

Basically I am saying, please plan for this (didn’t I mention the importance of planning last week?) It’s here for 2015 and ignoring it is not going to make it go away.

If this blog post has made you break out in a cold sweat, all is not lost! Contact us, we can help you with a plan.

We work with companies on a project basis or on retainer, providing a custom level of HR help designed for your business, with offices in Austin, San Antonio, Dallas and Houston. Contact me at Caroline@valentinehr.com or call (512) 420-8267